Rethinking Retirement Planning

Summary: The old model of retirement no longer works. Financial stability across a longer lifespan requires far greater flexibility.

What a Recent WEF Study Reveals About the Global Savings Crisis

Welcome back to our series, The Financial Future of Retirement. If you've read Part 1, The Great Retirement Lie, you're already familiar with the shifting landscape of retirement planning and why the "retire at 65 and sail into the sunset" model no longer serves us.

What happens after that "retirement date" when life expectancy stretches decades longer than anticipated? And how can individuals and advisors alike adapt to this fundamentally new reality?

This post dives deeper into why traditional systems are failing and explores forward-looking strategies midlife professionals can use to secure their financial future in the face of a mounting global retirement savings gap.

- Part 1: The Great Retirement Lie

- Part 2: Rethinking Retirement Planning For a Nonlinear Life (You're here)

- Part 3: Practical Money Strategies for Longevity

Why Retirement Planning Must Evolve

For decades, retirement planning was a straightforward three-step process:

- Work full-time until you're 60 or 65.

- Save and invest diligently throughout your career.

- Stop working and live off your savings or pension.

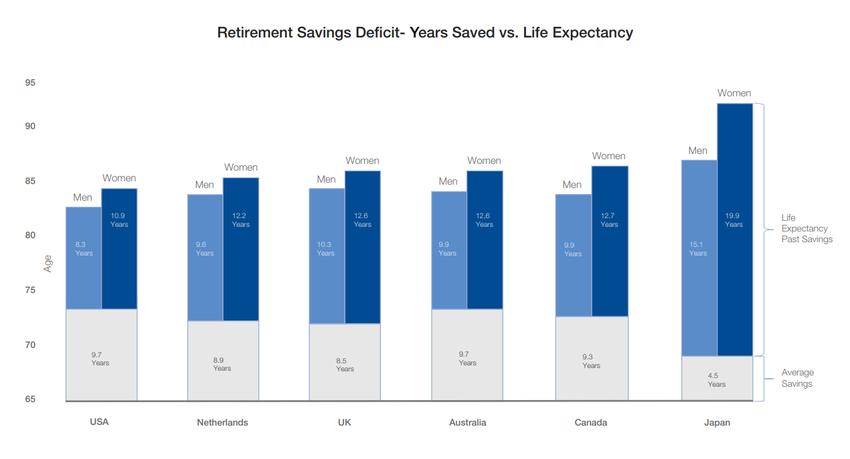

This plan worked—for a while. It was designed during a time when people lived 10-15 years post-retirement. But today’s reality is astonishingly different. Many individuals will live for 30, even 40 years after they leave the workforce—much longer than the system was built to sustain.

This isn’t just about needing to save more. It’s about completely rethinking what retirement looks like.

What does this mean for how we save, work, and ultimately, live in retirement?

- Instead of fully ending work, more retirees are transitioning into hybrid retirements.

- Savings alone are no longer enough—diversified income streams and smarter investment tools are a necessity, not a luxury.

- Retirement is no longer an endpoint—it’s a series of life stages that require adaptability, flexibility, and foresight.

But adapting to these realities isn’t just on individuals—it’s also about confronting a global financial system that’s struggling to keep up.

The Global Retirement Savings Gap

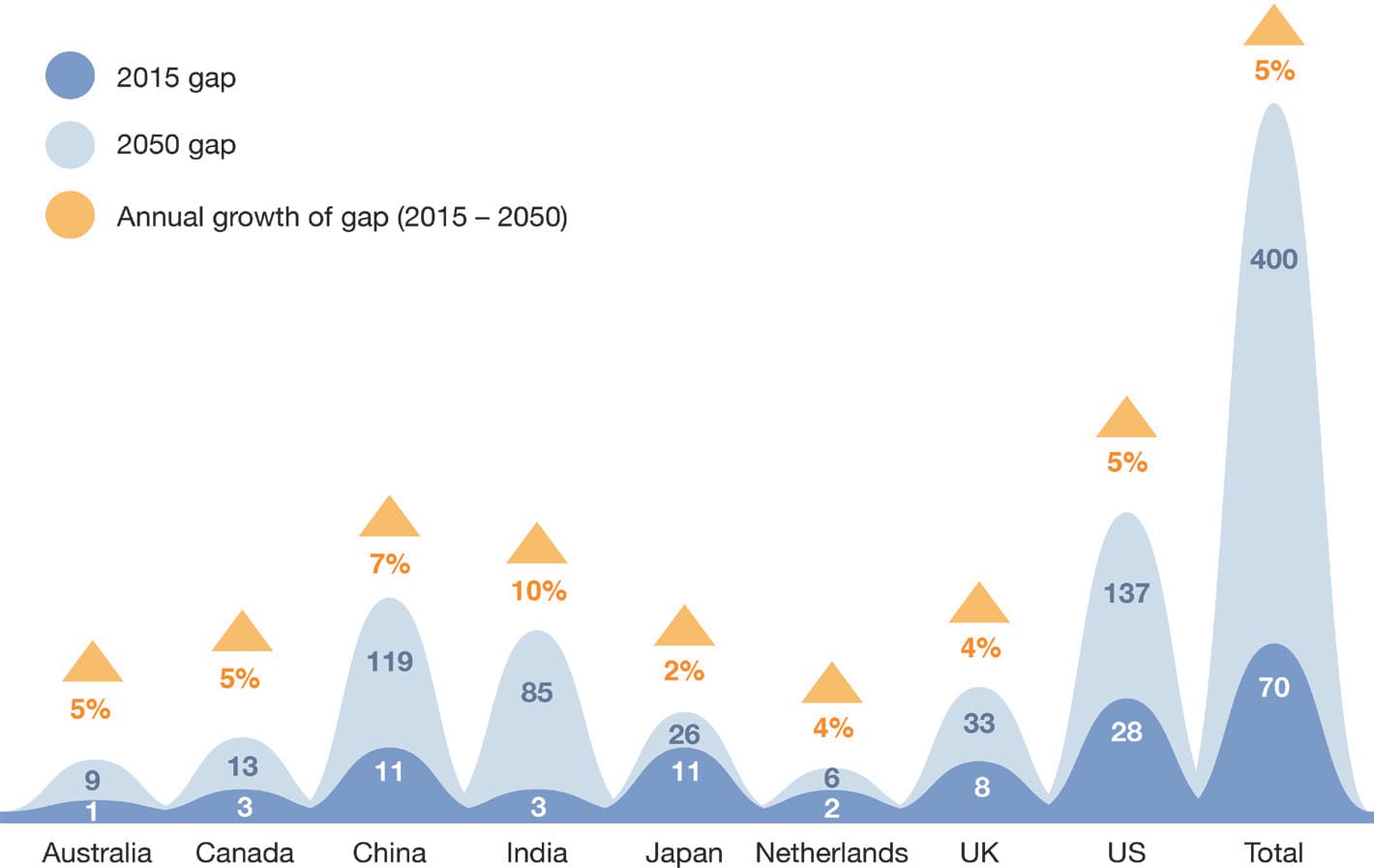

Here’s a wake-up call for all of us navigating life in the 21st century. The World Economic Forum projects that the global retirement savings gap—the shortfall between what people have saved and what they’ll need for retirement—will balloon from $70 trillion in 2023 to a staggering $400 trillion by 2050.

What’s Causing This Shortfall?

The failure lies not just with individuals—though many are saving less than they should—but also within outdated systems we rely on.

Traditional Pensions on the Brink

- Government pensions weren’t designed to fund 30+ years of retirement. They’re feeling the strain of longer life expectancies and shrinking worker-to-retiree ratios.

- Many countries are experiencing pension funding shortfalls as fewer workers sustain a growing population of retirees.

What You Can Do: Build financial independence by diversifying income sources and saving more instead of depending solely on government pensions.

Most People Aren’t Saving Enough

The reality is stark. Many individuals are saving far less than the recommended 15-20% of their annual income, often putting away less than 10%. Rising living costs, healthcare, and inflation further accelerate the erosion of savings.

What You Can Do: Start increasing your contributions where possible. Leverage tax-efficient savings systems like a Roth IRA (US), ISAs (UK), or superannuation (Australia) to grow your nest egg effectively.

Self-Employment and Gig Work Challenges

- Gig workers, freelancers, and self-employed professionals struggle without access to employer-backed retirement plans.

- Without employer-matched contributions, these workers face enormous individual responsibility to save for the distant future.

What You Can Do: Open a Solo 401(k) (US) or a Self-Invested Pension Plan (SIPP) (UK) to bridge the savings gap. Platforms like Vanguard or Fidelity are excellent for managing these self-directed accounts.

Why Retirement Systems Are Crumbling

The retirement models we rely on today don’t reflect the realities of modern aging, work patterns, or family dynamics. The World Economic Forum report recently outlined four key challenges to modern systems:

- Limited Access to Savings Plans: Think gig workers, freelancers, or employees of small businesses—many of these individuals lack formal systems to set aside funds for their later years.

- Low Financial Literacy: A shocking number of us don’t understand critical concepts like compound interest or inflation, leaving individuals ill-equipped to manage modern defined contribution (DC) plans.

- Insufficient Savings Rates: Most people don’t come close to saving the recommended 10–15% of their annual income.

- Risk Shifting to Individuals: The transition from defined benefit (DB) to DC plans has placed a disproportionate burden on individuals to manage investments and risks, leading to financial insecurity for many.

Clearly, as midlife professionals, we need more accessible tools, sharper education, and reimagined solutions to thrive in a world that’s increasingly putting retirement responsibilities on our shoulders.

Call to Action for a Future-Forward Retirement

For midlife professionals—those balancing mortgages, careers, caregiving, and constantly shifting life priorities–the future of retirement isn't just about a spreadsheet forecast.

What's needed is a nonlinear life strategy that can withstand change, uncertainty, and different priorities.

- Financial risk is no longer just about running out of money. Good financing (in addition to good health and good relationships) will give you good life options for your evolving circumstances.

- The next few chapters of your life should not just be about stability - but also growth and reinvention. Don't make it about constraints and anxiety.

- Your most important asset is not your savings–it's adaptability!

What’s Next?

In Part 3, where we’ll shift focus from the systemic issues explored here to personal strategies for building a flexible, resilient, and opportunity-rich retirement plan.

Q: What steps are you taking today to rethink retirement for your future self?